Cash Cows eventually carry parity and security to a portfolio. This 'overabundance cash' should be 'drained' from the Cash Cow for interests in different specialty units (Stars and Question Marks). Along these lines, cash cows ordinarily produce cash in an overabundance of the measure of money expected to keep up the business. As a result of the lower development rate, ventures required ought to likewise below. Since they despise everything that has a substantial relative piece of the overall industry in a deteriorating (developed) market, benefits and cash streams are relied upon to be high.

At this stage, your Stars are probably going to change into Cash Cows. In the long run, if you are working for quite a while working in the business, advertising development may decay, and incomes deteriorate. Since the development rate is high here, with the correct systems and ventures, they can become Cash cows and, at last, Stars if they have a flat piece of the overall industry so that off-base ventures can downsize them to Dogs significantly after loads of speculation. Like the name proposes, the future capability of these items is dubious. Items situated in this quadrant are appealing as they are located in a hearty class, and these items are exceptionally serious in the classification. Star units are pioneers in the classification.

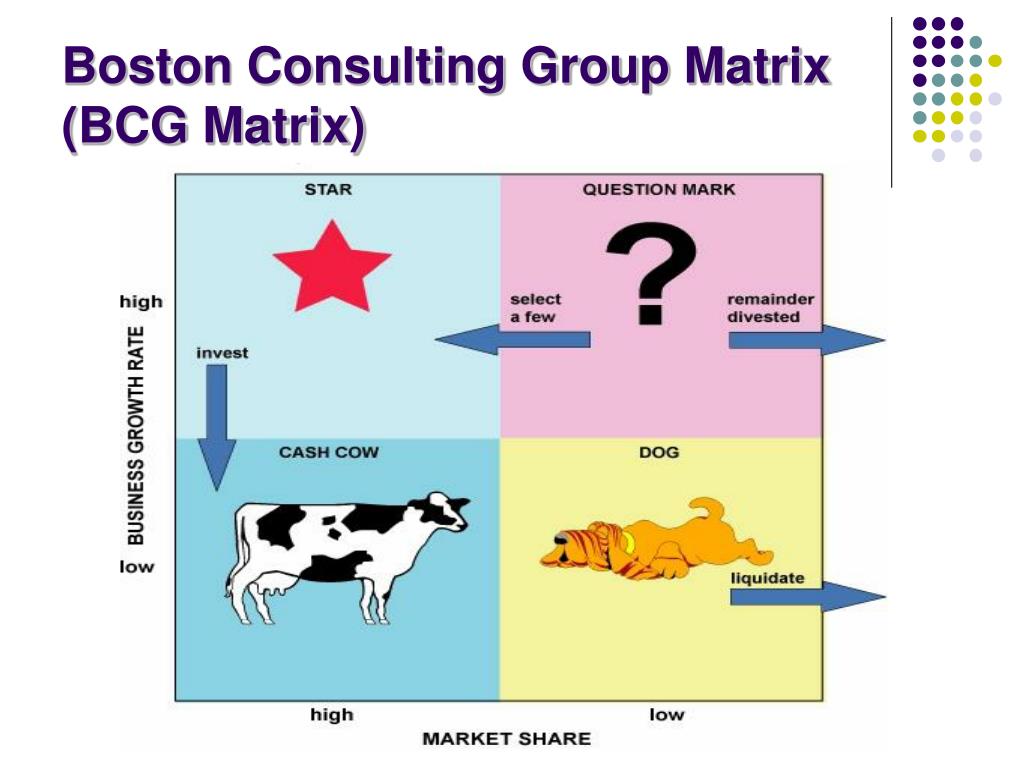

It depends on the mix of market development and the overall industry comparative with the following best contender. The Matrix is separated into four quadrants dependent on an investigation of market development and the relative peace of the overall industry. It's otherwise called the Growth/Share Matrix. The Boston Consulting Group's item portfolio matrix ( BCG matrix), otherwise called the Growth/Share Matrix, is a vital arranging device that enables a business to consider development openings by inspecting its arrangement of items to choose where to contribute to suspend or create things. Calculate Relative Market Share & Find out the Market Growth Rateīy and tremendous Growth rate in Coke is that it is no: in more than 200 countries. Also, you need to identify the market, as the picked market is beverages, diet cokes, and mineral water. We pick the firm Coca-Cola for investigation. Yet, none of them is anyplace near the coke brand in terms of mindfulness, income, and benefit. Here are the example list:Ī world-driving ready-to-drink refreshment company, Coca-Cola Company has more than 500 soda pop brands, from Fuse Tea to Oasis to Lilt to Powerade. You could utilize this if checking on a scope of items, particularly before growing new ones. The BCG Model depends on items as opposed to administrations, be that as it may, it applies to both. 01 10 Examples of BCG Matrix (of famous companies)ġ0 Examples of BCG Matrix (of famous companies).

0 kommentar(er)

0 kommentar(er)